$79 Premium Only Cafeteria (POP) Plan

EMPLOYERS: UPDATE YOUR SECTION 125 PREMIUM ONLY PLAN (read more)

$79 - Premium Only Cafeteria Plan (POP) - Complete!

|

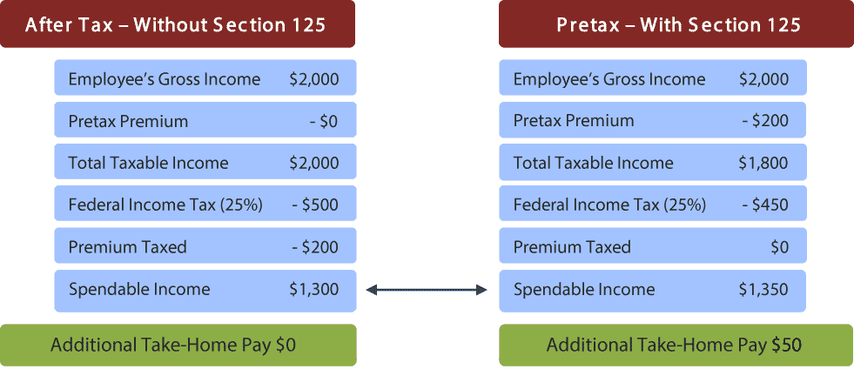

Known by a variety of names (cafeteria plan, Section 125 cafeteria plan, POP plans, etc.), a premium only plan allows your employees to pay their portion of premiums for certain employer-sponsored benefits (e.g., health, dental, vision, and life coverage's) with pre-tax dollars. While your employees lower the impact these costs have on their take home pay by contributing pre-tax, you, the employer, save money on the matching FICA and Medicare taxes.

With these FICA and Medicare savings, you will find that typically this benefit more than pays for itself. |

Same day - complete plan document sent via email

Benefits of a Premium Only 'POP' Plan

- Pre-tax employees premium payments

- Employers get a tax savings of 7.65% on FICA taxes on employee premium contributions

- Employees can receive tax savings of up to 30% on FICA, federal and most state income taxes

- Employees reduce their taxable income, increasing take-home pay

- Can be integrated with almost every payroll program for automated contributions and simplified plan administration

- A powerful tax incentive to help recruit and retain quality employees

- No annual fees

Order your $79 Premium Only Plan and be able to

deduct employee insurance premiums pre-tax today!

Most orders and plan documents are processed and emailed same day

If you are deducting employee insurance premiums pre-tax without having a IRC Section 125 Premium Only Plan document on file, you could be found out of compliance on an audit.

The penalties are enumerated in the IRS Code Section 125 to include the following:

The penalties are enumerated in the IRS Code Section 125 to include the following:

- Fines of up to $5,000 or imprisonment of up to 1 year for willful violation of ERISA provisions;

- Fines of up to $10,000 and/or imprisonment of up to 5 year for making any false statement or representation of fact, knowing it to be false, or for deliberate non disclosure of any fact required by ERISA;

- A penalty of $110 /day for failure to distribute a Summary of Plan Description or SPD to participants within 30 days of request;

- A Department of Labor (DOL) penalty of $100/day, up to a maximum of $1,000 if an SPD is requested and is not provided within 30 days.

Copyright © 2023, Cafeteria Plan Direct All rights reserved